Regulation in Blockchain: While the US represses and Europe legislates: What does Argentina do and what could it do?

Every day we are receiving news —and very strong ones— in the field of regulatory and police policies in the sector blockchain and the crypto economy.

In general, those of us who see this sector as something positive for the development of a better society distrust regulations and governments. It is not for less: they are much more suspicious of us than we are of them, and we believe that they would like us not to exist. Not having to deal with this reality that has come to them, just now, when they already had almost all financial movements under control.

But we not only exist, but we continue to live in these societies, with these governments, and it is our responsibility to investigate and make proposals that make more sense than those that they can generate. And that they are implementable.

The US represses and Europe legislates

After dalliances and threats the Securities and Exchange United States Commission (SEC), in charge of regulating and monitoring the securities markets, sued Coinbase and Binance to stop operating in the public offering and exchange of crypto assets.

Binance is the largest crypto asset exchange platform, o exchange , with presence all over the world. Coinbase has the largest operation in the United States, and is the one that is most inserted into the traditional economy, since it lists its own shares on the NASDAQ.

The SEC's main argument is that on the exchanges that operate these exchanges , crypto assets are publicly bought and sold that are in essence marketable securities , or securities, and that neither crypto assets nor exchanges have prior SEC clearance which is required by law.

This action by the SEC comes after an extensive list of measures that have been taken against other less notable platforms and against issuers of crypto assets in particular. Many of these attacks were closed with fines and agreements to stop operating in the United States.

Many others are waging costly and risky judicial and media battles. In the case of Ripple —one of the five cryptocurrencies with major market cap , and notoriously centralized—, a judge recently rejected partially the SEC's submissions, by not considering securities the tokens sold in exchanges , to the general public.

Something similar happens in the banking sector. The run on Signature, Silvergate and Silicon Valley Bank (SVB) banks brought to the table an apparent dislike or discrimination of the banking regulatory authority — the Federal Deposit Insurance Corporation (FDIC) — which was accused of discriminating against banks that were friendly to the crypto ecosystem (after that run the stablecoin USDC, which operated with the SVB, lost a third of its market capitalization. And it did so at favor of its competitor USDT, which is seen as less exposed to regulatory authorities and the US banking system).

In short, the ecosystem blockchain is today on the warpath with the Democratic administration of Biden, which is branded as an enemy of innovation, and accuses it of acting through the policy that they call something like "regulation by repression" ( regulation by enforcement ).

Meanwhile, some republican pre-candidates for president begin to use the financial freedom of crypto as a campaign theme. Federal bills come and go but none take flight. And the biggest players are moving headquarters and operations to other countries.

In Europe the great novelty of this year 2023 was the approval of the MiCA Law , with application throughout the European Union but deferred entry into force until the middle of next year.

In this dense regulation, Europe mainly proposes to submit to support and transparency requirements the issuances of crypto assets that represent goods and/or currencies, and to demand the approval and control by the European Banking Authority (EBA) regarding the stablecoins due to their volume and circulation, such as USDC and USDt, which are the only ones that currently exceed the floor of 5,000 million Euros of market capitalization defined by this law (and that it is unlikely that they will stop circulating and being available to Europeans, just because MiCA or the EBA say so).

It also establishes the operation and support conditions that crypto-asset service providers must comply with, especially exchange and deposit platforms, and some more or less predictable requirements for them Utility tokens.

But the MiCA Law does not apply to crypto assets that could be considered financial instruments, which in Argentina we call negotiable securities, the securities for American law. That is to say, that all the current discussion in the United States could be presented in exactly the same way in Europe, even under the little enlightening (and very extensive) MiCA Law.

technology is not killed

Meanwhile, the Bitcoin continues to be mined and it continues to be traded at prices and daily volumes that, although they are far from the peaks of two years ago, do not cease to surprise —and sometimes anger— those who do not understand its value. The same Ether and hundreds of other crypto assets of the most diverse types.

And also new projects and solutions continue to be developed in blockchain , posing a growing challenge to the people and companies to which they are directed, and - of course - to governments and regulators around the globe.

There is no doubt that there are many of the brightest minds in the world committed to developing this sector. Mathematicians, computer scientists, economists, statisticians and cryptographers, who talk about things that cannot be seen or touched, that are almost impossible to understand for those of us looking at them from the plain... and that move a lot of money. Are they crazy, are they all con men and drug dealers, or are they pointing fingers at us and paving the way to a whole new, unknown, and better world?

In my judgment (and in my limited personal experience), if Bitcoin survives, and if the technology and projects in blockchain advance is for something more than the mere greed of some public savings swindlers, tax evaders and money launderers of illicit origin (which, of course, why wouldn't there be).

It's the magic of the Internet of Value, of the Web3 (the Internet of reading-writing-having), a technology that allows people to communicate and transfer value without intermediaries. Without even using money (or this money), which is the most universal way of communicating.

It's privacy, the security , transparency, lower costs, financial inclusion and —in short— the promise of a better, freer and fairer way of organizing ourselves in a digital society.

What worries the world's governments the most is that many crypto assets have real economic value, have markets, are transferable within and beyond the political limits of territories and jurisdictions and the effective power of governments.

And that they touch, get entangled and make noise with the payment and circulation systems of the fiduciary currencies that those governments control, and with which they are financed, with the banking, credit and capital systems; they capture (and put at risk) public savings, and generate profits and assets that are not easy to capture with taxes.

And that technology —like ideas— cannot be killed.

The relative tolerance and uncertainty of Argentina

Driven by the need for financial survival in a repressive, chaotic and inflationary economy, but also by the creativity, lateral thinking and disruptive mindset of many young people, the crypto ecosystem in Argentina is in excellent health. Grow and set directions.

The attitude of the authorities has generally been one of tolerance, or non-aggressive ignorance. There have been few regulatory events worth mentioning: in 2014 " virtual currencies " entered the UIF's sights but only to the extent that they were moved by subjects already obliged to report, in 2016 we received a fiscal shock (for the equivocal inclusion of " digital currencies " in the income tax law); in 2022 the AFIP increased the fiscal focus on local exchanges by incorporating information systems and the Executive Branch limited tax exemptions to checks; in 2022 the Central Bank prohibited banks from offering crypto products to their customers; and in 2023 that ban was extended to fintechs (PSPs).

Apart from this, tolerance with local exchange platforms is maintained, and access to them is available to anyone, to buy or sell the main crypto assets, whether against pesos or against dollars, whether to enter or exit with fiat or with crypto. .

These exchanges they try to do good handwriting, self-regulate and apply KYC standards even stricter than those required by law for banks and formal capital market clearing and settlement agents (ALyC).

Not only for preserving their good reputation, but for fear that the banks will close their accounts and prevent them from operating with fiduciary money, which would imply the immediate death of their main business. A business that already has between 5 and 10 million open accounts in the country.

At that point we were in Argentina, when someone included in the bill to reform the Money Laundering Law the creation of a Registry of Virtual Asset Service Providers (PSAV), and the granting to the National Securities Commission ( CNV) of a carte blanche to regulate and supervise all activities related to the exchange, deposit, transfer and administration of crypto assets.

The project did not have any debate or analysis, and it clearly exceeds the purpose of the rest of the law, which consists of updating the money laundering control rules to the new FATF standards, which did include covering the PSAV as obligated subjects of register and report to the FIU.

The truth is that this registry and the regulatory delegation —which were not in the project of the Executive Power— already have half the sanction of Deputies. I believe that soon we will have to know if the Senate makes it law, and if the Executive Power promulgates it.

Now —whether the regulatory delegation project to the CNV prospers or not—, in the aforementioned international context, and in the current state of maturation of the blockchain ecosystem in Argentina, it is true that the movement towards some regulation seems imminent.

Regular, for what?

If it is about regulation, it is important to first establish the purpose and effectiveness of the system that you want to establish.

The most genuine and substantial interest of the regulator to establish a police system on the crypto economy is the risk of public savings: preserving the market from scams, abuses and negligent insolvencies. Protect people and the market from credit risk and moral hazard from bad actors.

This is risks particularly difficult for users to assess due to information asymmetries and the cost of overcoming those asymmetries. And it is true that losses that go beyond the risk foreseeably assumed by a responsible user affect the legitimate interests of the people who suffer them, and also negatively affect legal certainty and the productivity and efficiency of the entire economy.

Apart from this negative interest of the regulation, it is possible to identify a positive and circumstantial interest or objective: adequate regulation can facilitate the growth of a new market, the access of Argentine companies to financing and investment opportunities, generate more investment and work in this promising sector of the economy.

Especially if it is about taking advantage of the opportunity offered by the gaps and hostilities that the most developed economies are generating.

Other possible regulatory purposes (for example, tax collection or money laundering control) must be analyzed within the scope of each of these particular systems (tax, money laundering control), subject to the dynamics and principles of fiscal policy. , adaptation to international policy (GAFI, IMF, etc.). As in fact —and badly or well—, it has been done up to now.

By not compromising the protection of public savings or the rights of users, these issues should be prevented from distorting the design and debate of a global regulation of the ecosystem blockchain .

On the other hand, the effectiveness —in administrative law it is called reasonableness, adequate proportion between the means used and the ends pursued— of the measures that are taken must condition their design and issuance.

Approving unenforceable or unenforceable measures also produces legal uncertainty, arbitrariness, and an inefficient system, because it generates asymmetric restrictions, arbitrariness, and sanctions only for a few. And they contribute nothing to protect public savings.

So, the regulation that is proposed here is one that is useful and effective for the protection of public savings, without failing to take into account the positive effect that can be achieved for the growth of the ecosystem.

regular, about what

Let us now see the matter on which regulation is called. I believe that the central criterion that should guide the understanding of this ecosystem at the time of its regulation is that of decentralization. Not for nothing to technology blockchain it's called “distributed ledger technology” (TRD, or DLT, by decentralized ledger technology).

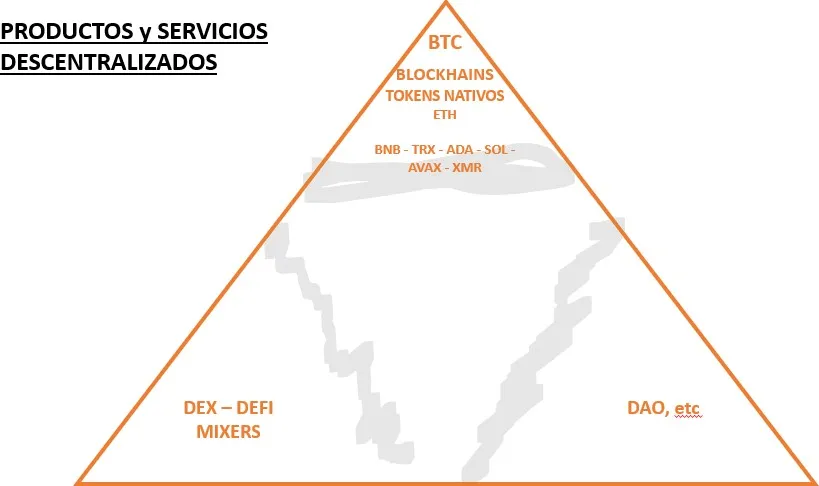

In the ecosystem blockchain there are many products and activities of very different types and even substance. Simplifying as much as possible this complex and changing universe, (and without ignoring the usefulness of other usual classifications), I would say that there are decentralized and centralized crypto assets, and that there are also decentralized and centralized services or activities.

The classification criteria is decentralization, the degree of decentralization , because decentralization is the great finding and the value of blockchain : a protocol that can be deployed on the Internet, and function without depending on anyone in particular.

Thus, in cases of maximum decentralization, whether of certain crypto assets (Bitcoin, Ether), or of certain services or networks (for example, exchange and investment platforms Uniswap , Sovryn, or mixer protocols such as- -nbsp; Tornado Cash ), there is no issue that can or makes sense to be regulated.

These crypto assets and decentralized services do not respond to any regulatory order, nor do their users assume any credit risk.

The market prices of these crypto assets and services may fluctuate and produce profits or losses, and some decentralized protocol may fail or be violated, but in no case is there an issuer that can fulfill or fail to fulfill its promises (because there are no such promises or there is no such issuer), or that it may receive instructions or sanctions for not complying with them.

It is true that in decentralized products and services there are technical, design and security risks, but the code of decentralized protocols is open, unrestrictedly available for anyone to audit. That is why it can be presumed which are risks that are assumed in a free and informed manner.

And the lack of information should not be attributable to anyone other than the person who assumes it. Maybe —and just maybe, the topic is debatable—, who takes advantage of a design feature (A flaw?) to enrich themselves at the expense of third parties in a way not intended by bona fide players.

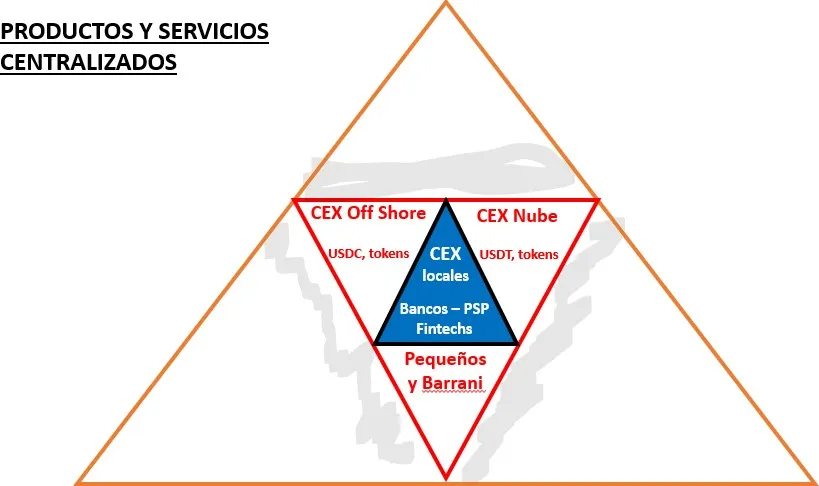

But there is blockchains decentralized, and there are also those that are centralized, or relatively centralized. And it is still possible —supported by the security of a more or less centralized blockchain— to issue crypto assets that function as decentralized, in which the issuer is completely free of interest and power and decision.

Both of them are listed on platforms such as Binance and Coinbase, and they are the ones that the SEC considers securities , and you don't like them being traded without your permission.

The discussion on the subject is arduous (it is consuming millions of dollars in legal fees). And it is that decentralization is a matter of degrees, nuances, factors and criteria, and for this reason there are greys: protocols that are moderately decentralized, that are in transition towards greater decentralization, or others that invoke only apparent decentralization, only as screen of a government and operation —of a business, in short— that are essentially and intentionally centralized.

And there are also —of course— crypto asset deposit, exchange or investment services that are totally centralized, and not even developed on blockchain .

They are only linked to the ecosystem because they provide these services to crypto asset owners. Some more detailed and with a real business base in a developed economy, others more borderline and elusive.

Among these service providers (there are extensive ones and also cross-border ones), there are deposit and exchange platforms with legal headquarters and business base in Argentina, which aspire to provide their clients with the exchange service for pesos and dollars, in addition from other services for your crypto assets, such as -cryptocurrencies-2020/">trading and access to investment platforms.

The possible axes of a healthy regulation

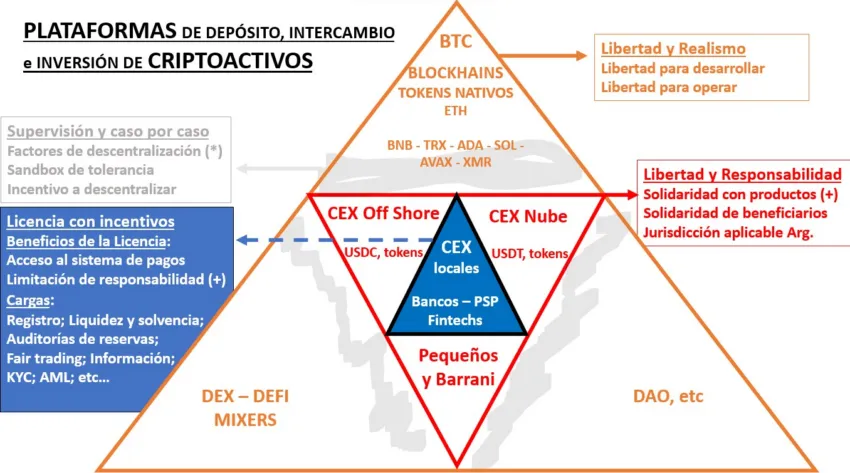

I already said that decentralized platforms and protocols are neither a matter of regulation nor necessary, useful or possible.

In the cases of crypto assets and centralized platforms, on the other hand, the people who access them are subject to credit risk —sometimes— and moral hazard —always—, of whoever proposes and disposes of the characteristics, promises and functionalities of the cryptoactive, protocol or platform.

In these cases, talking about regulation begins to make sense. There are also technical and security risks, but regulation tends to be less useful in this field, since here the one most interested in having a good standard is the organizer or service provider (and they are also usually better able to evaluate it than the regulator).

Well, we know that in centralized products and services, public savings are at risk. But even there, the question of effectiveness reappears, of the possibility and interest in enforcing any regulation that tends to mitigate or control moral and credit risks.

Because it's useless prohibit the issuance and circulation of a cryptoactive or the provision of a service, if despite being centralized, its issuance and control are exercised from some remote place, or under some effective screen to hide those responsible.

The transnational nature and the cryptographic and anonymous environment in which crypto assets move poses a level of unattainability that is materially different from that of all known services in the traditional world and even in the digital world of the Web2 .

Something —the truth is that not much— to limit the total freedom of these crypto assets is what the government guns do and the incentives of developers to access the enormous market of the United States. But with respect to our small market, the global crypto-economy is totally out of reach of the cannons and radars of our more than modest government.

And if nothing can be usefully regulated with those who hide, why and for what should something be done with those who show their faces.

So, is it that nothing can be done to preserve public savings, not even in the field of centralized blockchain products and services and crypto asset services?

Two things can be done, two rules (or two sets of rules) that can be followed in a sound regulation. The first is common law: making those who act outside of the law fully and legally accountable to their users. regulatory radar.

The second rule is administrative law: it consists of providing regulatory benefits to those who agree to operate under predetermined rules of responsibility and transparency.

The first rule would apply to all crypto assets and centralized crypto assets services, or that do not have a minimum level of decentralization and transparency that allows ruling out credit risk and moral hazard inherent to the centralization of decisions.

The rule is to give the best that the fund law can offer: a tool or legal action to the user or investor to demand adequate compensation in case of breach of obligations, promises or legitimate expectations generated.

To claim who? To all those who profited from the issuance, placement, marketing and promotion of the cryptoactive or centralized service. To claim before whom? Before the justice of the place where that cryptoactive or service was accessed by the injured user.

This rule is nothing that comes out of the consumer law standards (Laws 24,240 and 26,993). But perhaps it is necessary to specify better what is the risk of the consumer that deserves legitimate protection, and the scope of the compensation.

Naturally, not the price variation of a crypto asset due to mere market forces. But possibly the recovery of the cost of an investment made in a centralized crypto asset that was manipulated by its issuer, and/or by a-- nbsp; exchange centralized. These are questions to deepen.

Both in order to enforce civil liability and, where appropriate, criminal liability, the most important thing is to guarantee the victim a clear and explicit rule of territorial jurisdiction accessible as a user. Provide the jurisdiction of the place of use or access, even when the conditions predisposed by the person in charge establish any other jurisdiction.

The jurisdiction extension clauses must be considered null and void. This rule is also consistent with consumer law (CCCN art. 2654 and Law 26,993, art. 50), and it is reasonable because it refers to a jurisdiction relevant to the legal relationship: the place where the business with the user was consolidated, the fact, the acceptance, in his case the deception.

That's all. That, and criminal justice for cases in which non-compliance would also have consisted of a crime. It is not worth wearing down or swelling the regulatory bureaucratic structures to act against those who fly, or may fly, under the radar.

The second rule is based on recognizing the fact that if in the world of cryptoeconomics it is possible to move outside the regulatory radar, an incentive must be provided for some issuers of crypto assets or centralized service providers,- -nbsp;that they agree to accept a certain standard that the regulator deems appropriate to preserve the user from their risks that can be protected (moral hazard and credit risk).

For service providers, the regulatory incentives would consist of allowing them access and interaction with the payment system (CBU and CVU accounts), and the limitation of liability regarding what is done within compliance with mandatory regulations and with decentralized crypto assets, or with centralized crypto assets that in turn comply with the regulatory standard.

For the users of these centralized registered platforms, the biggest advantage would be to have wealth separation rules, which assure you availability of assets in custody of exchange .

In the traditional capital market, the collective deposit system governs by which the custody of assets (shares, debt securities) is entrusted to the Caja de Valores, which acts as Central Securities Depository Agent, which makes the assets independent of users of operators' credit risk (Law 20,643, Chapter III).

This system is what comes to replace the blockchain for users who operate and safeguard their crypto assets in a decentralized manner on decentralized systems, and it is the best explanation of why these cases do not require regulation or legal protection.

But in the world of centralized regulated platforms, the way in which the deposit is made, the custody of crypto assets is something to evaluate: Collective deposit, proof of reserves , reserve trust? In this type of asset, greater centralization in an independent platform (eg a collective deposit platform) may mean greater legal certainty, but it does not necessarily imply greater technological security.

Should regulated centralized exchanges be allowed to trade crypto assets not regulated or authorized ? The answer is undoubtedly affirmative with respect to those crypto assets that have a high level of decentralization.

With respect to others, it would not make sense to prohibit it (if unregulated exchanges are not prohibited either) but it should be clear that in the event of operating with this type of asset, the civil liability of the--nbsp is fully exposed; exchange . It is another incentive for the regulated world to operate with the standards set by the regulator.

For issuers of centralized crypto assets, the rule of limitation of liability (of the issuer and of all those who act in the organization, promotion and marketing) and eventually their interaction with the payment system may also be applied.

The latter would seem more unusual (although not impossible), since crypto assets generally do not act against fiat currency, but rather are written and redeemed, or their benefits are perceived against other crypto assets.

The discussion about whether or not they are negotiable securities is over: the centralized crypto assets authorized by the regulation would be negotiable securities, substantially the same as those approved today by the CNV as shares or negotiable obligations. Welcome to web3 the stock exchanges, the Electronic Open Market (MAE).

Hence, another reasonable and equitable regulatory incentive would also be to guarantee these types of issues the same tax benefits that those enjoy, although I have already said that tax issues should be dealt with by the tax system, and not within this framework.

The regulatory burdens that service providers and issuers of centralized crypto assets should accept for these purposes would be similar to those of the traditional capital market: liquidity and solvency rules, information transparency, management of reserves, independent audits, administrative verifications, approvals and prior authorizations, etc. etc

We are left with the gray areas. Crypto assets and protocols that are neither fully decentralized nor clearly centralized. These are not going to apply for a license or comply with a regulation (if they did, that regulation of the centralized mute would be applied to them, but this is unlikely).

So, the question is reduced to determining, case by case, if it is a decentralized system or not, based on principles, factors and decentralization criteria that can be legally stated.

Case by case, but not to be evaluated universally and priori by an administrative police authority. This would be endless, partial, insufficient, useless. On a case-by-case basis, to be defined by the judicial authority to which a certain victim attends with a particular claim, against a particular person responsible.

Lastly, and also referring to this gray area, the usefulness of the regulation offering certain safe zones ( safe harbours, sand boxes ) could be evaluated so that protocols that are born centralized, but head towards decentralization in good faith, can transit in a way that does not expose the responsibility of its developers beyond their obligation of good faith and reasonable diligence.

It would be a voluntary regime, eventually useful and beneficial to promote decentralized products and services.

Because decentralization is the value to preserve.

summarizing

In summary, the regulatory approach on which it is proposed to advance contemplates:

- Recognize and respect that decentralized products and services continue to be developed independently of any regulation.

- Avoid regulatory prosecution against non-decentralized products and services, but make it easier for the user to claim before developers, promoters and marketers of such centralized products and services, making them responsible and suable in the country in the event of breaches of obligations, promises and legitimate expectations generated for the users. users. Establish relevant decentralization factors and criteria to guide the judge in identifying when intermediate cases deserve to be considered decentralized and when not.

- Benefit with access to the payment system and with the limitation of liability to crypto asset deposit, exchange and investment service providers who agree to register and comply with the standards of transparency, solvency and good governance established by the regulatory authority. The same with respect to issuers of centralized crypto assets, including those that qualify as tradable securities.

- Preserve a safe zone, with limitation of liability and transparency and good governance rules, for the development of new products and services aimed at decentralization, while they travel the path towards said decentralization.