Solana Leads Layer-1 Token Gains as Bitcoin Crosses $38K

Crypto market capitalization rose 2.3% in the past 24 hours.

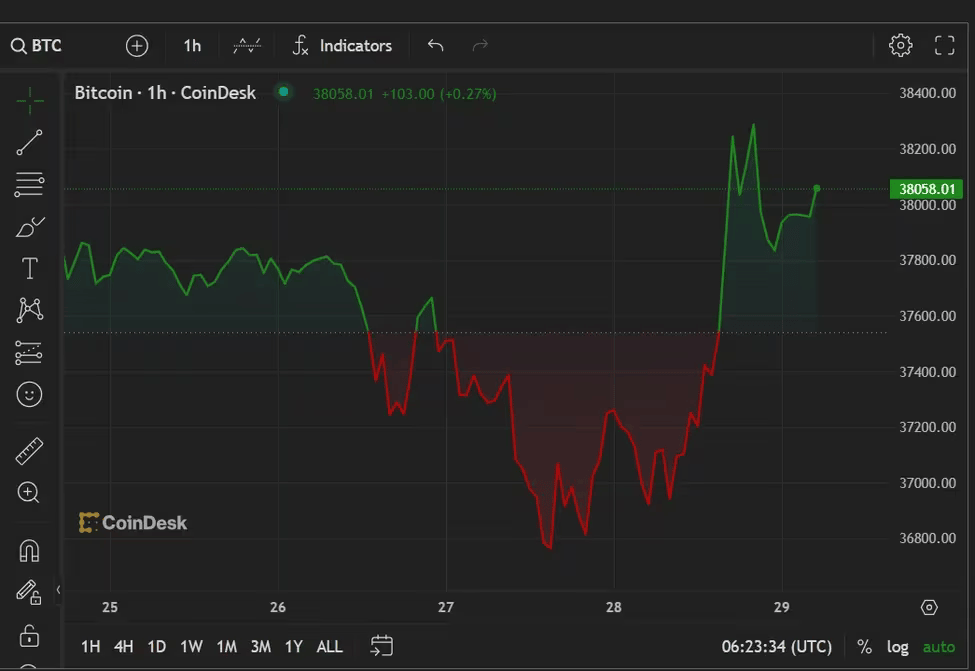

Bitcoin broke above the $38,000 mark early Wednesday. (CoinDesk)

Bitcoin broke above the $38,000 level in Asian morning hours on Wednesday as hopes around a spot exchange-traded fund (ETF) approval were revived earlier this week, and traditional market watchers expected rate cuts.

Solana’s SOL tokens led gains among layer-1, or base, blockchains, jumping some 8% in the past 24 hours to reverse losses from the past week. Avalanche’s AVAX bumped 6.6%, while Cardano’s ADA and Tron’s TRX rose over 5%.

The CoinDesk Market Index (CMI), a broad-based index that tracks the crypto market, rose over 2.5%.

Bitcoin momentum started to rise late Tuesday as Federal Reserve governor Chris Waller said recent data suggested a slowdown in the economy and continuing moderation in inflation showed current policies were in the “right spot.”

Waller also said that if inflation were to continue to decline, there's a good argument to be made for rate cuts within a few months.

Interest rate decisions have the tendency to move markets. Higher rates usually mean risk assets such as stocks and cryptocurrencies take a hit as investors could take profits and invest in bonds.

Elsewhere, global bank Standard Chartered double-downed on its April forecast that bitcoin (BTC) would reach $100,000 by the end of 2024. Analysts reasoned the expected approvals of several spot bitcoin ETFs “are likely to come sooner than expected,” which could act as catalysts for an uptrend.

Edited by Sam Reynolds.