What is Launchpad?

A launchpad is a platform that helps startups launch their products or services. In the crypto space, a launchpad is usually a token sale platform that helps projects raise funds and launch their tokens.

Launchpads typically provide support in areas such as marketing, community management, and technical development. Many launchpads also have a vested interest in the success of the projects they help launch, as they often receive a percentage of the tokens sold.

Launchpads have become increasingly popular in the crypto space, as they provide a way for projects to raise funds and launch their tokens without going through the traditional VC route.

How Do Crypto Launchpads Work?

Crypto launchpads are a type of platform that helps blockchain projects raise funds and launch their tokens. They typically work by selling a project’s tokens to accredited investors in exchange for a percentage of the project’s total token supply.

The funds raised through a crypto launchpad can be used to help finance the development of the project, pay for marketing and PR, and cover other expenses.

Each launchpad has its own listing requirements and terms of service, so be sure to do your research before selecting one.

The Benefits of Launchpads

Cryptocurrency launchpads have become increasingly popular in recent years as a way to fund new projects and to help them gain traction in the market.

There are several benefits that a launchpad can provide. First, it can help to increase the visibility of a project and to get it off the ground quickly. Second, a launchpad can provide much-needed funding that can be used to develop the project further. Third, a launchpad can help to build a community around a project and to get people excited about it.

How can users participate in the LaunchPad project?

Users must complete the following steps to participate in Launchpad projects and invest in projects of relative quality at an acceptable cost.

Step 1: Stake governance tokens in Launchpad. It should be noted that the method of committing different Launchpads may be different. There are three common commitment methods as follows.

1. No upper and lower limit, zero threshold commitment: share ratio = time * commitment amount / total pool. This method of participation is the easiest way to participate in the project. But there are always two sides of a coin, and a zero-threshold pledge means that there may be many users participating in the project, so the user may not have much at his disposal in the end.

2. There are upper and lower limits, low-threshold commitment: For this commitment method, although it is similar to the zero-threshold commitment method, due to the upper and lower limits of the number, the degree of user commitment is limited, which allows users to a certain extent, the amount obtained is relatively average.

3. Quota determination, lottery commitment: compared with the above two commitment methods, the quota proportion of this commitment method is determined at the beginning, and every user who participates in the commitment may not be able to get the quota, just like buying a lottery. This commitment method is equivalent to buying a lottery ticket, some people will go home empty-handed and some people will win a lot of money.

Step 2: KYC Verification. Generally speaking, the first thing users should do to participate in LaunchPad projects is to complete KYC verification, that is, Know Your Costumer real name verification link. Because KYC verification can effectively prevent the flood of bots and solve the compliance problem to some extent.

Step 3: Request a whitelist. Users should pay attention that the whitelist request is made within a specified time period. If the whitelist request is not made within the specified time and is passed, there is no way to participate in the project.

Step 4: Make a purchase within a certain IDO quota. The underlying calculation idea of quota is generally based on quantity and time, meaning that the more governance tokens a user has in LaunchPad, and the longer the commitment time, the more quota can be effectively exchanged. However, users should realize that the price of governance tokens is floating. If LaunchPad has a popular project landing, the demand for governance tokens will increase, resulting in an increase in the price of governance tokens in LaunchPad; when the IDO in LaunchPad ends, there is no follow-up of a promising project, there will also be users who choose to sell governance tokens, leading to a drop in the price of governance tokens in LaunchPad. Therefore, it is also critical to control the cost of LaunchPad governance tokens.

Step 5: Claim tokens. After purchasing, users just need to wait for the game to activate and then receive in-game tokens. However, the user does not receive all the in-game tokens at once, but gets a certain percentage of the in-game tokens when the game goes online, and the remaining tokens are given to the user over a period of time.

What Are the Best Crypto Launchpads?

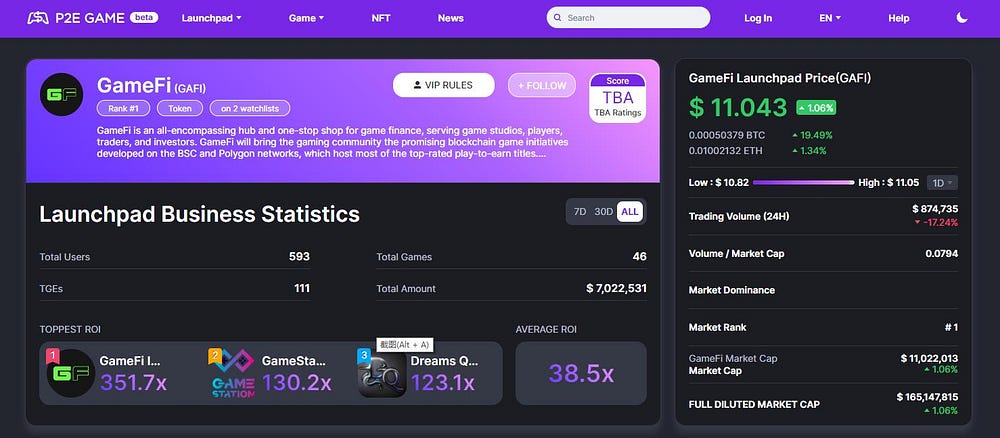

1. GameFi (GAFI)

GAFI has successfully launched 111 projects, and the average ATH ROI is 38.5X, the overall data is very good. And the three most successful projects inGAFI obtained an excellent ATH ROI of 351.7X, 130.2X and 123.1X respectively. Overall the results are very good.

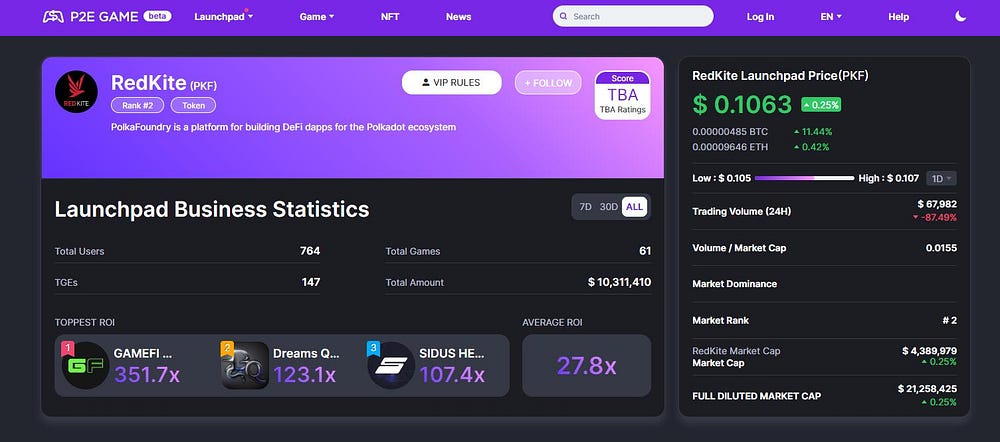

2. Red Kite (PKF)

PKF has successfully launched 147 projects, and ATH’s average return on investment is 27.8X. The overall data is relatively good. And the three most successful projects inPKF obtained an excellent ATH ROI of 351.7X, 123.1X and 107.4X respectively. Overall, the results are relatively good.

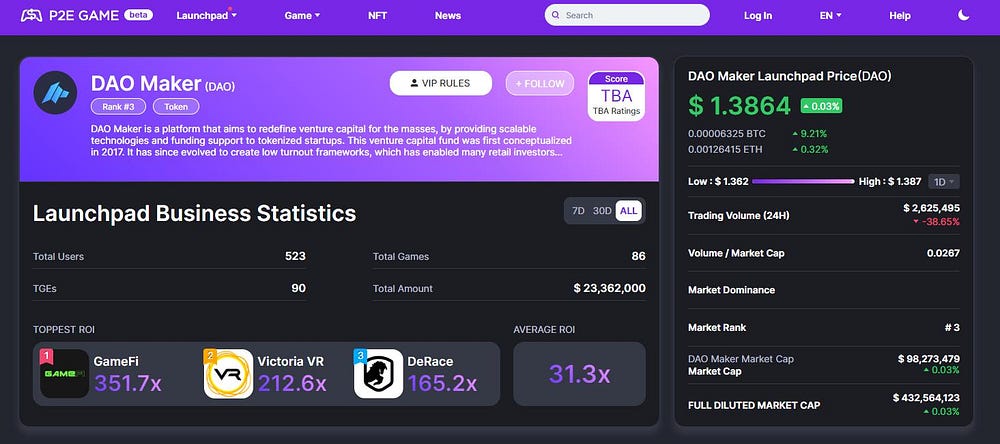

3. DAO Maker (DAO)

DAO has successfully launched 90 projects, and the average return on ATH investment is 31.3X. Although there are relatively few projects launched, the overall data is relatively good. And the three most successful projects inDAO obtained an excellent ATH ROI of 351.7X, 212.6X and 165.2X respectively. Overall the results are quite good.

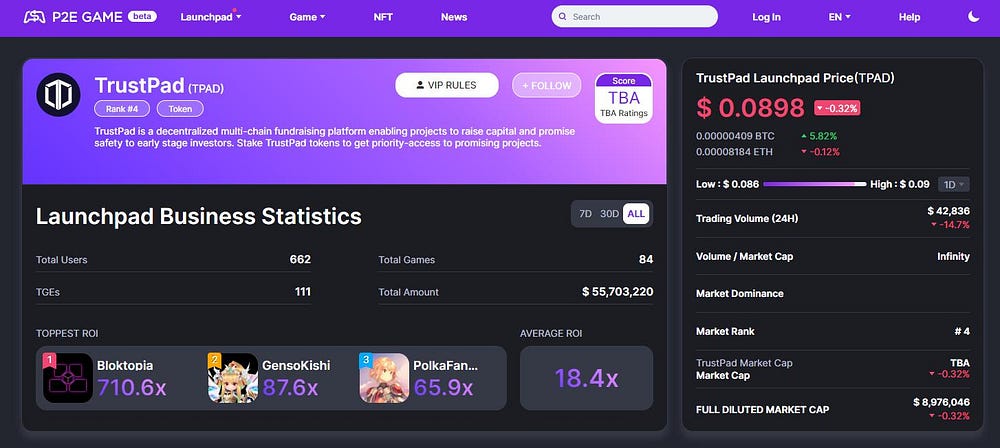

4. TrustPad (TPAD)

DAO has successfully launched 111 projects, and the average ROI rate of ATH is 18.4X. It can be seen that the average ROI rate of ATH is relatively small, but the fluctuation is very large. The most successful project inTPAD achieved an ROI of 710.6XATH, and the best results since then were only with the ATH ROI of 87.6X and 65.9X. Overall, the results are relatively good.

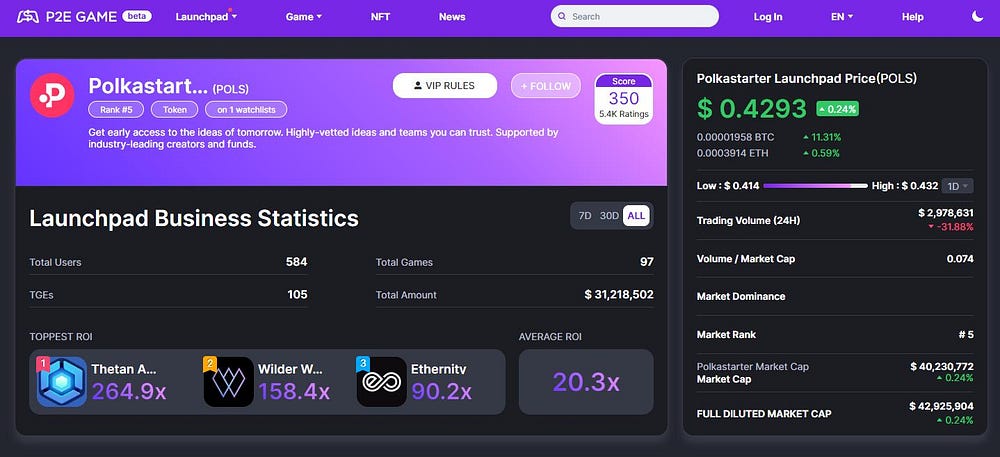

5. Polkastarter(POLS)

DAO has successfully launched 105 projects, and ATH’s average return on investment is 20.3X. The overall data is relatively average. And the three most successful projects inPOLS achieved ATH ROI of 264.9X, 158.4X and 90.2X respectively. Overall, the scores are normal.

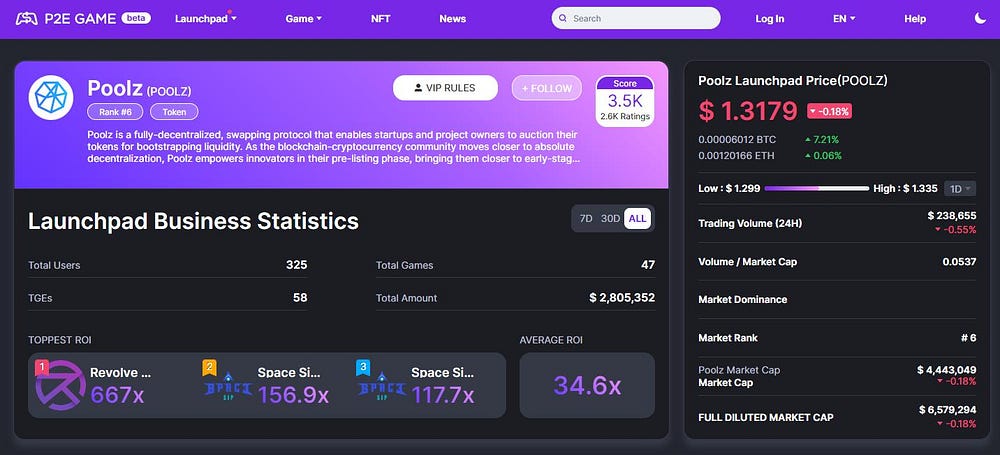

6. Piscinaz(PISCINAZ)

POOLZ has successfully launched 58 projects, and the average ATH ROI is 34.6X. Although there are fewer online projects, the overall data is very good. And the three most successful projects inPOOLZ obtained an excellent ATH ROI of 667X, 156.9X and 117.7X respectively. Overall the results are quite good.

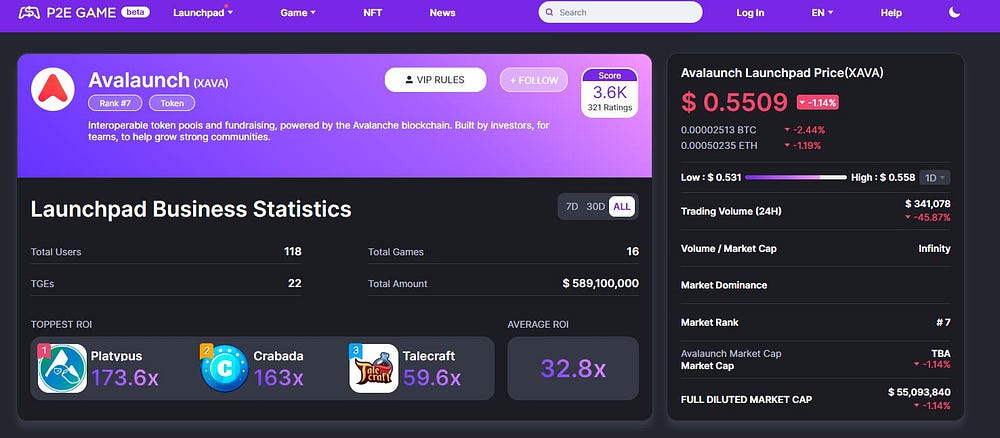

7. Avalaunch(XAVA)

XAVA has successfully launched 22 projects, and the average ROI rate of ATH is 32.8X. Although there are few projects online, ATH’s average ROI rate is very good. The three most successful projects inXAVAachieved an ATH ROI of 173.6X, 163X and 59.6X respectively. Overall, because there are very few projects, the results are mediocre.

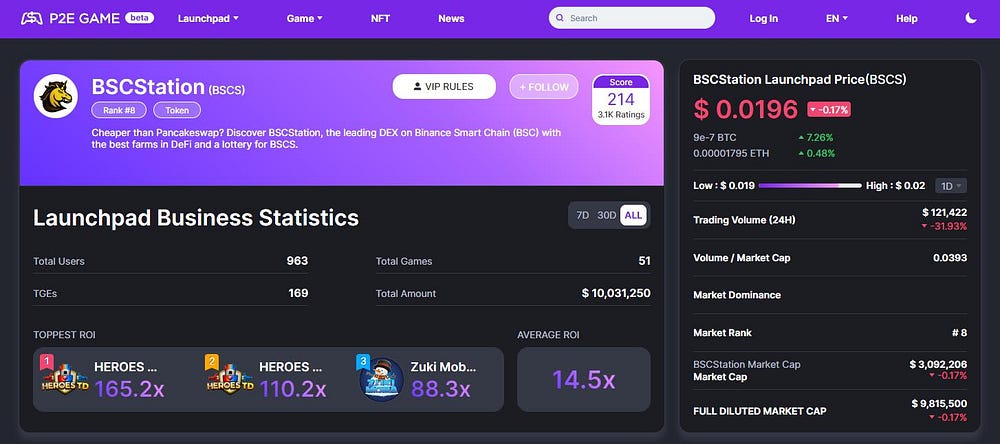

8. BSC Station (BSCS)

There are 169 projects successfully launched by BSCS, but the average ATH ROI is 14.5X and the overall data is not ideal. And the three most successful projects inBSCS achieved an ATH ROI of 165.2X, 110.2X and 88.3X respectively. Overall, the results are normal because the average ATH ROI is not ideal.

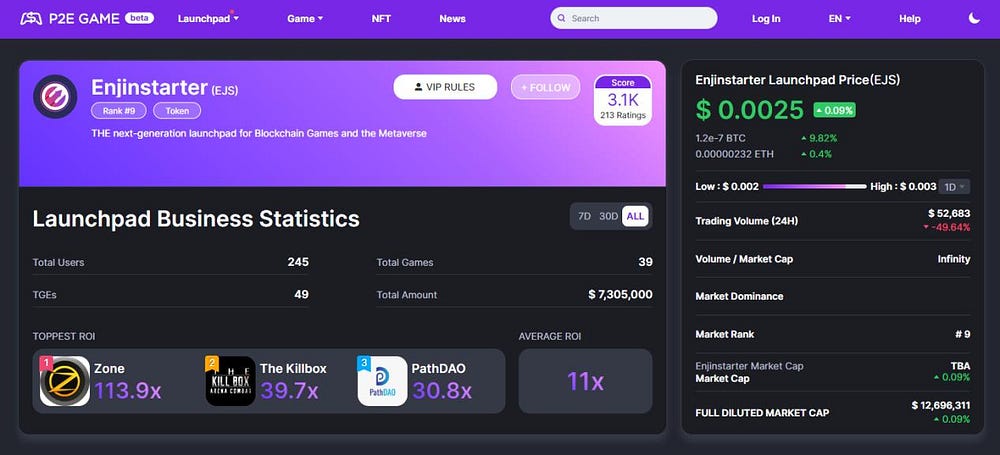

9. Enjin Starter(EJS)

EJS has successfully launched 49 projects, but the average ATH ROI is 11X, and both online projects and average ATH ROI are relatively small. The three most successful projects inEJS only achieved an ATH ROI of 113.9X, 39.7X, 30.8X. Overall, the results are normal.

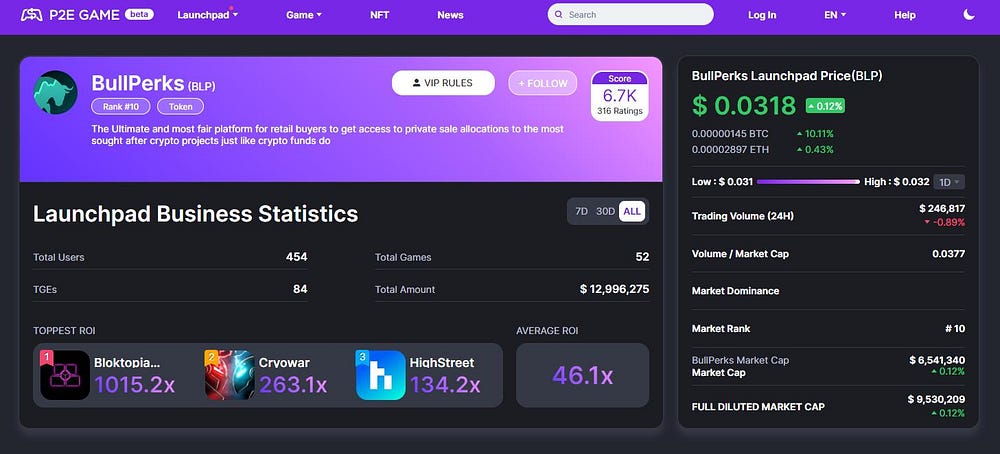

10. BullPerks(BLP)

BLP has successfully launched 84 projects, and the average return on investment of ATH is 46.1X. Although there are relatively few projects launched, the overall data is very good. The three most successful projects at BLP achieved excellent ATH ROI of 1015.2X, 263.1X and 134.2X respectively. Overall the results are very good.

All of the above launchpads have some common advantages, such as a large number of launched projects, a high average ATH ROI, a relatively good user base and community activity, and either the integrity of the project preview parameters or the integrity of the project detail parameters, a high degree of completion has been achieved.

Likewise, the disadvantages are almost the same, such as less sharing of project news and information; ATH investment returns fluctuate too much due to the risks inherent in the investment itself.

The Conclusion

Launchpads are an important part of the crypto ecosystem. But this doesn’t mean that every launchpad or all the projects that are registered on launchpads will be successful.

This requires the launchpad team to be outstanding, and also depends on whether the launchpad can attract high-quality projects to choose from.

Reviews